Segment the customer base by frequency, age and solvency

RFM Analysis is a quintessence of ABC Customer Analysis and Outflow Analysis in your company. ABC segments customers by a number of payments, and Outflow-Flow shows how long you have been buying. At the same time, RFM segmentation allows you to combine these indicators in a single report and visualize the data in a new cut.

RFM Acronym (Recency Frequency Monetary) - Customer segmentation in Loyalty Sales Analysis .

It is divided into three groups and determined based on the following hypotheses:

- Recency - the recency of transaction, the more time has passed since the client's last purchase, the less likely it is that he will make a new purchase.

- Frequency - the number of deals, the more purchases a client makes, the more likely it is that he will make a purchase in the near future

- The more money the client has paid, the more likely it is that he will make a new order.

We have added this report to our "Main Company Dashboard", which you can see on the link and video.

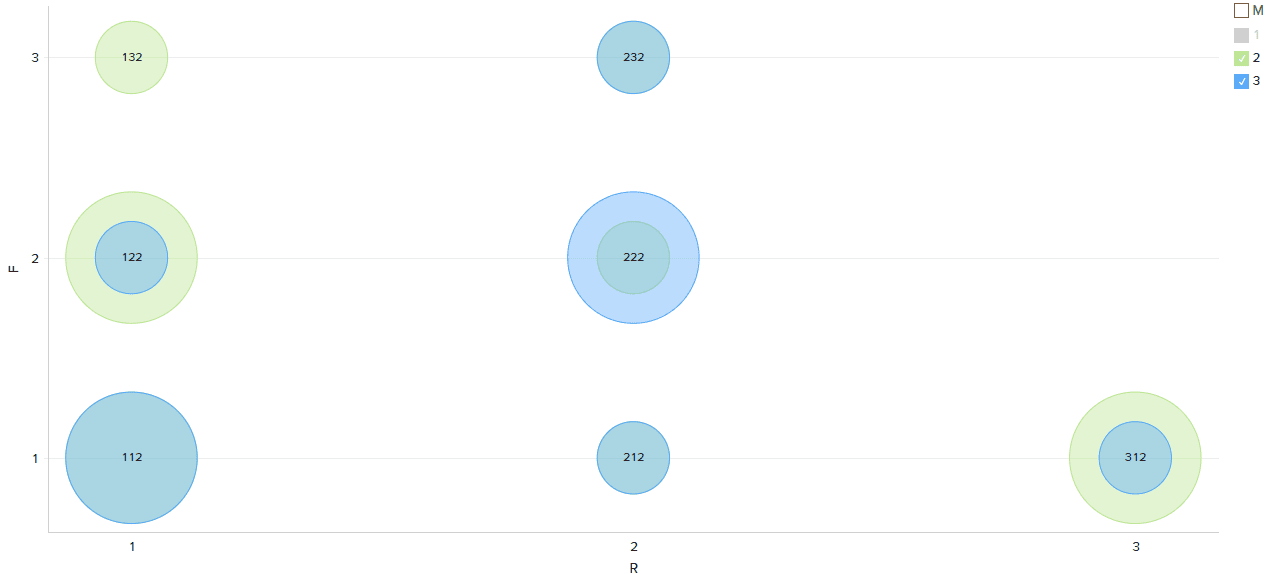

So, we divide each group into three categories, for ease of segmentation.

A long time ago:

1 - last purchase more than 70 days ago (outflow),

2 - purchase of more than 35 days (candidate for outflow),

3 - purchase less than 35 days ago (active client)

Frequency

1 - less than 5 purchases,

2 - from 5 to 10 purchases,

3 - more than 10 purchases

Money (in our report we used the average check)

1 - average check less than 10 000 UAH

2 - average check from 10 to 15 thousand UAH

3 - average check over 15 thousand UAN

These categories are conditional and are given here as an example. There can be many more of them, and grouping can take place by other rules.

What we get as a result:

111 - this is a customer who has not bought for a long time, bought rarely and with a low check, that is, we are least interested in ))).

333 is a dream client, buys expensive, often and currently active.

133 - this customer has been buying very well, but he hasn't been ordering lately.

222 is our "middle class" - buys rarely but always with a good middle check.

etc.

RFM analysis allows you to correctly segment a dynamic customer base, and apply the right actions to reactivate or increase the life cycle of each customer group.